Furthermore, individuals dealing with time-sensitive obligations, like securing an actual estate deal, may additionally benefit from the expedited strategy of no-document loans.

Furthermore, individuals dealing with time-sensitive obligations, like securing an actual estate deal, may additionally benefit from the expedited strategy of no-document loans. The capacity to skip traditional mortgage complexities permits borrowers to grab opportunities rapidly with out the long wait typical of normal lo

Need quick money and wondering where to turn? The concept of a 24-hour

Loan for Housewives provides a lifeline for many individuals going through urgent financial needs. This kind of mortgage can be essential in emergencies, enabling borrowers to entry funds swiftly with out the extended wait typical of traditional lending avenues. It's important to understand the nuances, advantages, and potential pitfalls of those loans to make knowledgeable decisions. In this article, we will discover the ins and outs of 24-hour loans, alongside how Be픽 can enhance your understanding and experience with t

Lastly, Day Laborer Loans can even contribute to building a positive credit history when repayments are made on time. By responsibly managing a mortgage, day laborers might enhance their creditworthiness, opening doors to extra favorable monetary merchandise sooner or la

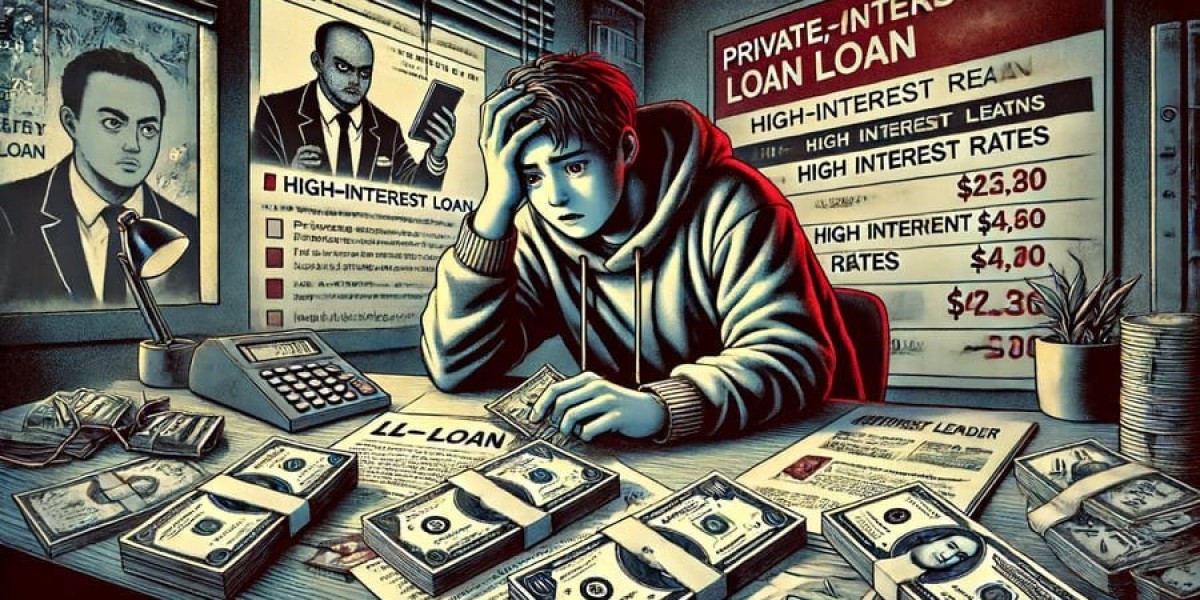

Potential Risks and Considerations

While there are quite a few benefits to 24-hour loans, it’s necessary to consider the potential dangers involved. One of probably the most distinguished points is the **high-interest rates** associated with these loans. Due to the fast accessibility of cash, lenders often charge larger fees compared to traditional loans, which might lead to monetary strain if debtors do not manage repayments effectiv

Discover More with Bepick

For these thinking about no-document loans, Bepick provides complete information and critiques to assist navigate this financing choice. The website is dedicated to providing users with in-depth insights into numerous mortgage sorts, including no-document loans. With detailed comparisons, person experiences, and professional evaluations, Bepick is a useful useful resource for anyone considering alternative financing solutions. Understanding the intricacies of no-document loans will enable you to make well-informed decisions and choose the choices finest suited to your monetary wa

Once the mandatory documentation is compiled, borrowers can apply via on-line platforms, local lenders, or credit score unions. Completing the applying accurately and providing any requested data promptly can expedite the approval proc

Application Process for Freelancer Loans

The utility process for freelancer loans has turn into increasingly streamlined. Many lenders provide on-line applications, which could be accomplished in a matter of minutes. Applicants typically begin by offering primary personal data, income particulars, and the quantity they want to bor

After submitting the application, it undergoes a review course of, throughout which lenders assess the supplied documentation and creditworthiness. This evaluation can take anywhere from a couple of hours to a quantity of days, depending on the lender's practices. Once accredited, borrowers could must signal mortgage agreements that detail reimbursement terms, together with interest rates and reimbursement schedu

It's important to remember that this type of mortgage isn't appropriate for everyone. Those with steady employment and wonderful

Credit Loan score may discover better charges and terms with standard financing options. Weighing all options obtainable is important earlier than committing to any particular kind of mortg

n While 24-hour loans can meet pressing financial needs, several alternatives are price contemplating. Options like personal loans from banks or credit score unions usually provide decrease interest rates and favorable phrases. Additionally, borrowing from pals or family could also be an interest-free choice, although it requires careful consideration to keep away from straining personal relationships. Other alternatives embrace bank cards or negotiating payment plans with service provid

An necessary side of Day Laborer Loans is the rates of interest, which can range considerably. Depending on the lender's policies, some loans might have higher rates because of the perceived risks associated with lending to individuals with out conventional employment. It is crucial for borrowers to buy around, comparing charges and phrases across different lenders to secure one of the best deal attaina

Ultimately, no-document loans could be a useful device for these who

Business Loan need quick access to cash, however they should be viewed as part of a broader financial technique that considers risk tolerance and overall monetary stabil

Furthermore, these loans usually allow people to bridge the gap between paychecks. Since day laborers typically receives a commission day by day, getting entry to a mortgage might help handle money circulate until the next job is secured. This flexibility can cut back stress throughout lean monetary intervals, giving workers peace of mind as they seek out their subsequent employment alternat

Подробное описание покупки документов в знаменитом онлайн-магазине

بواسطة sonnick84 sonnick84

Подробное описание покупки документов в знаменитом онлайн-магазине

بواسطة sonnick84 sonnick84 Онлайн магазин, где возможно будет приобрести диплом ВУЗа

بواسطة sonnick84 sonnick84

Онлайн магазин, где возможно будет приобрести диплом ВУЗа

بواسطة sonnick84 sonnick84 Основные затраты изготовителя дипломов - авторский обзор

بواسطة sonnick84 sonnick84

Основные затраты изготовителя дипломов - авторский обзор

بواسطة sonnick84 sonnick84 Сколько именно стоить будет диплом в наше время?

بواسطة sonnick84 sonnick84

Сколько именно стоить будет диплом в наше время?

بواسطة sonnick84 sonnick84 С умом заказываем диплом в интернете - обзор

بواسطة sonnick84 sonnick84

С умом заказываем диплом в интернете - обзор

بواسطة sonnick84 sonnick84